โทรศัพท์

โทรศัพท์ การสื่อสารสองทางผ่านโทรศัพท์มือถือใช้คลื่นวิทยุในการสื่อสารกับเครือข่ายโทรศัพท์มือถือผ่านสถานีฐาน เครือข่ายโทรศัพท์มือถือแต่ละเครือข่ายของผู้ให้บริการแต่ละรายเชื่อมต่อกับเครือข่ายโทรศัพท์บ้านและเครือข่ายมือถือของผู้ให้บริการรายอื่น

Samsung

Samsung Galaxy S23 FE สรุปสเปกสุดปังที่ไม่ควรพลาด

Galaxy S23 FE สิ้นสุดการรอคอยสำหรับแฟนๆ ซัมซุง ด้วยการเปิดตัวมือถือรุ่นใหม่ล่าสุดอย่างยิ่งใหญ่ Samsung Galaxy S23 FE

รีวิว 5 วัน กับการใช้งาน Samsung Galaxy S23 Ultra

Galaxy S23 Ultra การมาถึงของ Samsung Galaxy S23 Ultra ถือได้ว่าสร้างความตื่นเต้นให้กับอุตสาหกรรมสมาร์ทโฟนไม่น้อย

โทรศัพท์ราคาไม่เกิน 10,000 รุ่นไหนดี สเปคแรงน่าซื้อ ปี 2024

สเปคแรงน่าซื้อ สำหรับใครที่กำลังมองหามือถือราคาไม่เกิน 10,000 บาท วันนี้ Samsung มีรายชื่อมือถือซัมซุงราคาไม่เกิน 10,000 บาทมาฝากครับ

โทรศัพท์ Samsung2024 มีรุ่นไหนน่าสนใจบ้าง

Samsung หากพูดถึงโทรศัพท์มือถือยี่ห้อต่าง ๆ Samsung ก็ถือว่าเป็นหนึ่งในยี่ห้อที่คนให้ความสนใจ และมีรุ่นมือถือให้เลือกค่อนข้างหลากหลาย

ซัมซุง เปิดตัว SamsungGalaxy Z Flip5 และ GalaxyZ Fold5

ซัมซุง เปิดตัวสมาร์ทโฟนหน้าจอพับได้รุ่นที่ 5 ทั้ง Galaxy Z Flip5 และ Galaxy Z Fold5 ด้วยดีไซน์โดดเด่นที่จะมอบประสบการณ์พิเศษให้กับผู้ใช้งาน

Samsung GalaxyA55 5G / A35 5G มือถือถ่ายวิดีโอ 4K

GalaxyA55 Samsung Galaxy A55 5G และ Galaxy A35 5G มือถือซีรีส์ A ปี 2024 สเปคระดับกลาง รุ่นเก่าอย่าง Galaxy A55 5G

OPPO

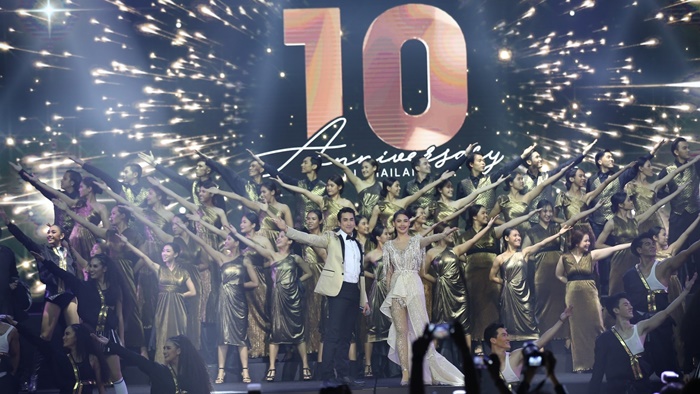

ย้อนรอย 10 ปี OPPO หนทางพิสูจน์ความสำเร็จ

10 ปี OPPO แบรนด์สมาร์ทโฟนจากประเทศจีนที่กลายเป็นแบรนด์สมาร์ทโฟนชั้นนำในหลายประเทศต้องยอมรับว่าปัจจุบันมีแบรนด์สมาร์ทโฟน

ข้อมูลสเปค OPPO Reno 8 Series หน้าจอไหลลื่น เน้นถ่ายรูปแบบสวยๆ

Reno 8 Series ส่วนวงการมือถือปีนี้เปิดตัวแบบไม่มีสะดุดเลย โดยเฉพาะรุ่นใหม่จาก OPPO เรียกได้ว่าเปิดตัวมาอย่างต่อเนื่อง

5 โทรศัพท์ Oppo รุ่นไหนดี ในปี 2024

รุ่นไหนดี ในตอนนี้ถึงแม้มือถือจะมียี่ห้อต่างๆ มากมาย ให้ทุกคนได้เลือกใช้ก็ตาม แต่อีกแบรนด์ที่ได้รับความนิยมอย่างมากก็คือแบรนด์

มือถือ OPPO 2024 รุ่นใหม่น่าสนใจ

OPPO ปัจจุบันมีมือถือหลายยี่ห้อที่จำหน่ายในประเทศไทยให้เลือก และ OPPO ก็เป็นหนึ่งในแบรนด์ที่มีคนสนใจไม่น้อย และมีให้เลือกหลายรุ่น

รีวิว OPPO Reno8 T 5G รุ่นใหม่ สมาร์ตโฟนกล้องพอร์ตเทรต 108MP

รุ่นใหม่ OPPO Reno Series เป็นอีกหนึ่งสมาร์ทโฟนตระกูลยอดนิยมในประเทศเราที่ขายดี และมีรุ่นใหม่ออกมาอย่างต่อเนื่อง

ถ่ายรูปดีจริงไหม? รีวิว “OPPO Reno8 T” มือถือกล้องปังในราคาหมื่นต้น

OPPO Reno8 T เปิดตัวมาได้สักระยะแล้วถึงจะไม่ใช่เรือธงแต่ด้วยคอนเซ็ปต์ของ OPPO Reno8 T ที่เป็น The Portrait Expert ถือเป็นสมาร์ทโฟนที่น่าสนใจ

vivo

ส่องสเปค รีวิว Vivo Y20 สมาร์ตโฟนราคาไม่โหดร้าย แบตใหญ่

Vivo Y20 “Vivo Y Series” ได้ยินชื่อนี้เมื่อไหร่? คุณจะรู้ได้เลยว่าเป็นสมาร์ทโฟนราคาประหยัด ความอเนกประสงค์ในตระกูลนี้

vivo Y17s เปิดตัวแล้ว! สมาร์ตโฟนน้องเล็ก สเปกครบเครื่อง

vivo Y17s กรุงเทพฯ 21 กันยายน 2566 – vivo แบรนด์สมาร์ทโฟนชั้นนำของโลก เตรียมเปิดตัว vivo Y17s สมาร์ทโฟนรุ่นใหม่ล่าสุด

มือถือ Vivo รุ่นไหนดี เครื่องสวย ถ่ายรูปชัด เล่นเกมมันส์ สเปคแรง 2024

เล่นเกมมันส์ ถ้าเราพูดถึงชื่อผู้ผลิตโทรศัพท์มือถือที่มีชื่อเสียงในประเทศของเรา เชื่อกันว่าเป็นชื่ออันดับต้นๆ ที่หลายคนนึกถึงก็คือ Vivo

รวมมือถือ vivo ราคาไม่เกิน 5,000 บาท

vivo โทรศัพท์ Vivo ขึ้นชื่อในเรื่องกล้องคุณภาพดีที่ถ่ายภาพได้สวยคมชัดโดยเฉพาะกล้องหน้าที่ถ่ายเซลฟี่ได้สวยงาม เหมาะสำหรับผู้ที่ชอบถ่ายรูป

รีวิว vivo V29 5G สมาร์ตโฟน Aura Light ในใจสายพอร์ตเทรต

vivo V29 5G เมื่อไม่กี่เดือนก่อน vivo ได้สร้างความฮือฮาให้กับวงการสมาร์ตโฟนระดับกลางด้วยการเปิดตัว vivo V27 5G ที่มาพร้อม

รวมจุดเด่น vivo Y76 5G สมาร์ทโฟนน่าใช้ ในราคาไม่ถึงหมื่น!

สมาร์ทโฟนน่าใช้ เตรียมอำลาปีเก่าและต้อนรับปีใหม่ ตลอดปีที่ผ่านมามีการเปิดตัวสมาร์ทโฟนหลายรุ่น ที่ตอบโจทย์การทำงานที่หลากหลาย

iPhone

5 เหตุผลที่ทำให้ iPhone XR ยังเป็นมือถือที่น่าซื้อน่าใช้

iPhone XR เชื่อว่าตอนนี้หลายๆ คนสนใจการมาถึงของ iPhone 11, iPhone 11 Pro และ iPhone 11 Pro Max สมาร์ทโฟนรุ่นใหม่

iPhone 15 เผยวันเปิดตัวแล้ว ! เช็กสเปกและข้อมูลหลุดต่าง ๆ

iPhone 15 ใกล้เข้ามาเรื่อยๆ โดยเหลือเวลาอีกเพียงไม่กี่วันเท่านั้นสำหรับการเปิดตัว iPhone 15 Series มือถือรุ่นต่อไปของ Apple

สุขภาพแบต iPhone ลดต้องเปลี่ยนไหม? รวม 10 อาการแบตเสื่อม

อาการแบตเสื่อม หากคุณใช้ iPhone มาได้สักระยะ และกำลังเผชิญกับปัญหาสุขภาพแบตเตอรี่ iPhone ของคุณลดลงใช่หรือไม่?

iPhone 2024 มีรุ่นไหนให้เลือกซื้อบ้าง

iPhone โทรศัพท์มือถือในยุคปัจจุบัน หากใครไม่ใช้โทรศัพท์ Android ส่วนใหญ่ก็คงเป็นผู้ที่ใช้ iPhone ของ Apple ซึ่งเป็นระบบปฏิบัติการ iOS

ส่องสเปก iPhone 15 ราคาไทยเท่าไร สเปกแรงแค่ไหน ตัวท็อป

ตัวท็อป เปิดตัวมือถือรุ่นใหม่จาก Apple iPhone 15 Series ที่มีการอัปเกรดชิปประมวลผลให้เร็วและแรงกว่าเดิม กล้องที่ถ่ายภาพได้มีประสิทธิภาพมาก

[รีวิว] แกะกล่องiPhone 15 Pro Max หลังเปิดตัวอย่างเป็นทางการ

แกะกล่องiPhone กลับมาพบกับรีวิวจากทีมงาน อีกครั้ง ต้อนรับเทรนด์ iPhone 15 Series หลังจากรีวิว iPhone 15 Pro ไปแล้ว